Whether you want to consolidate your credit card debt or need a lump sum of cash to pay for a home improvement or car repair, it’s comforting to know that you can receive a personal loan online quickly and easily.

Online lenders have made it simple to research and apply for a personal loan online, but there are a few crucial measures you should take to ensure a smooth transaction and a higher likelihood of approval.

Key Takeaways

Obtaining a personal loan online is often easier and faster than applying in person or by phone.

Online personal loans can be used for any purpose and are available to applicants with varying credit scores.

Personal loans provide a big sum of cash that is repaid in regular monthly installments.

When applying for a personal loan, you must supply documents that validate your identity and income.

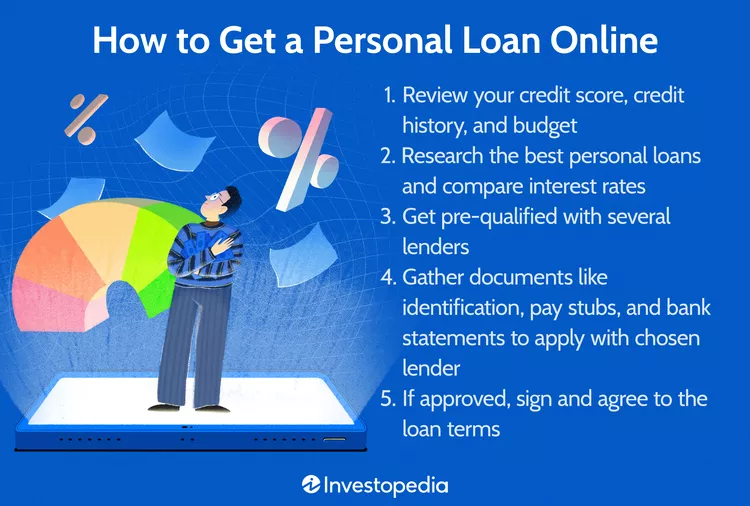

How to Get a Personal Loan Online?

Getting a personal loan online begins with examining your existing financial status and determining how much you need to borrow. From there, you may start your online personal loan search. Here are the most common steps in the procedure.

Review your finances.

Before applying for an online personal loan, you should understand your credit score and history. The higher your credit score, the more (and better) loan possibilities you’ll have. AnnualCreditReport.com provides free annual credit reports from the three credit agencies (Experian, Equifax, and TransUnion). You can also check your credit score online, using a credit card or bank account.

Next, analyze your budget to determine how much monthly loan payment you can comfortably afford. Making on-time monthly payments is critical for paying down your debt and keeping your credit strong.

Finally, decide how much you’d like to borrow. You’ll want a personal loan that’s substantial enough to cover your needs, but not so large that you end up paying more in interest. A larger loan may also harm your credit score because it carries more debt.

People with low credit can get online personal loans, but the interest rates will be higher.

Shop Online for a Personal Loan

Once you understand your credit and how much you require, you can look for a loan. Find the best personal loans online and compare interest rates and terms. Include offers from your present bank or credit union.

Consider aspects such as interest rates, fees, term options, how long it will take to receive your funds, and the lender’s customer service rating in internet reviews.

Get pre-qualified and choose a lender.

Once you’ve reduced your list of probable online personal loans to two or three, you can apply for pre-qualification if the lender provides it. Pre-qualification allows you to get an estimate of your costs without requiring a formal credit check. If the lender you’re interested in does not offer pre-qualification, you can still get a quote, but it may have an impact on your credit.

With all of this information, you can make an informed decision about which online personal loan is right for you.

Apply for the loan.

![Victoria University of Wellington Scholarship 2023 in New Zealand [Fully Funded]](https://ivoryscholarship.com/wp-content/uploads/2022/09/Victoria-University-of-Wellington-min.jpg)